- Operational Discipline

- Risk Management

- Consistent Method.

We will soon be offering Trade Assistant and Expert Advisor versions.

Why Trend Following?

Trend Following is a strategy that captures market trends without predicting the future—it simply goes with the flow. But why do you believe this? Because these giants don't just talk the talk; they walk the walk. They manage billions in assets for institutional investors, pension funds, and high-net-worth individuals. Their returns aren't luck: they're the result of systems tested in crises like the 1987 crash, the 2000 dot-com bubble, the 2008 Great Recession, and even the post-pandemic volatility of 2020-2022. According to studies by Société Générale and AQR Capital, Trend Following funds have delivered average annualized returns of 10-15% over the past 30 years, outperforming indexes like the S&P 500 during periods of turbulence. Now, let's get to the masters—get ready to be inspired!

1. Ed Seykota: The Pioneer of Emotional Discipline and Legendary Returns

Ed Seykota is often called the "father of modern trend following." He began in the 1970s developing computerized systems to capture trends in commodities. As the mentor of the famous Turtle Traders (an experiment that turned novice traders into millionaires), Seykota emphasizes operational discipline—one of the pillars of our Profitline.

Historical Returns: Impressive! From 1972 to 1988, his system delivered annualized returns of approximately 250% on an initial $5,000 account, turning it into millions (as reported in books such as Jack Schwager's "Market Wizards"). Throughout his career, average annual returns hovered around 20-30%, with drawdowns controlled thanks to rigorous risk management. In 2008, during the financial crisis, his systems captured downtrends, generating profits as the market collapsed.

Lesson for you: Seykota proves that trend following overcomes emotional bias. "Cut losses short and let profits run" – a mantra that Profitline automates for beginning traders.

2. Richard Dennis: The Creator of the Turtle Traders and Master of the Consistent Method

Richard Dennis, nicknamed the "Prince of the Pit" (due to his success on Chicago trading floors), is a legend who bet that trading could be taught. In 1983, he trained a group of "Turtles" in Trend Following, proving that a consistent method can be replicated.

Amount Under Management (AUM): Dennis managed funds that peaked at $200 million in the 1980s, but his legacy extends to firms influenced by him, indirectly totaling billions.

Historical Returns: The Turtles generated cumulative returns of over 80% per year on average during the experiment (1984-1988), with some years reaching 100-200%. Dennis personally turned $400 into $100 million in a decade. Even after retirement, his approach influenced funds with long-term annualized returns of 15-25%, according to CTA Intelligence analysis.

Imagine applying this: Profitline incorporates Turtle-like rules, a consistent method that anyone can follow—without years of training.

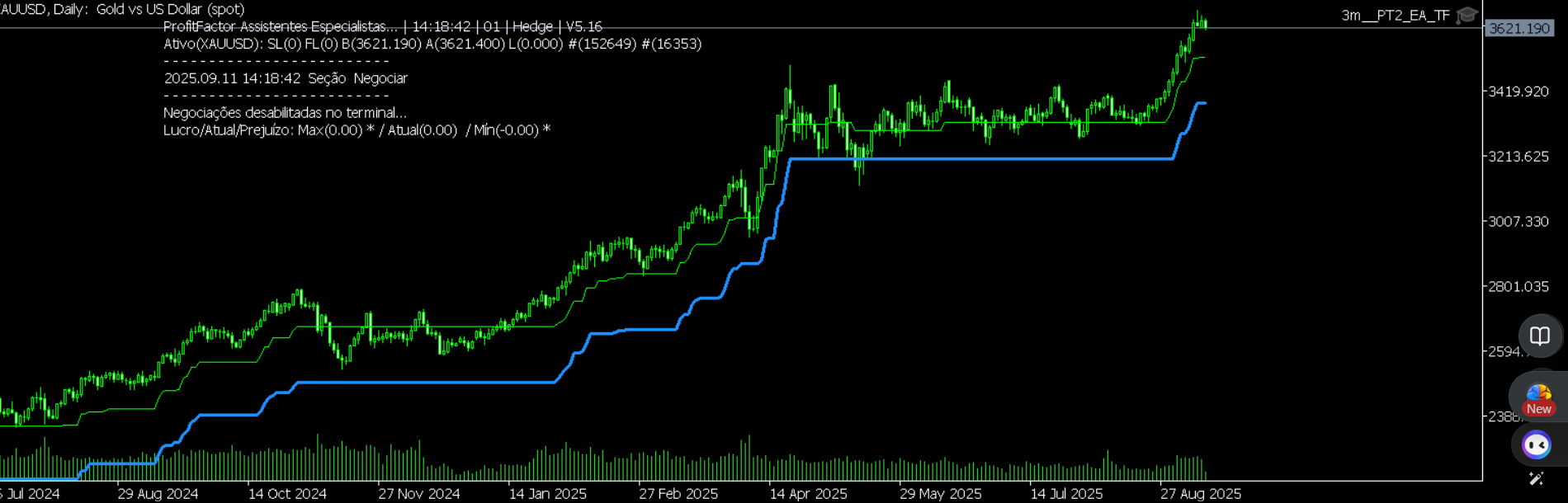

Below are some graphs from our Trading Assistant. It does not open orders, it controls the orders you place and manages these orders by making partial executions or stopping when the lines change color.

the daily Gold Chart