gbp usd

5m chart

up down v6

Re: $100 Up Down V6 indicator

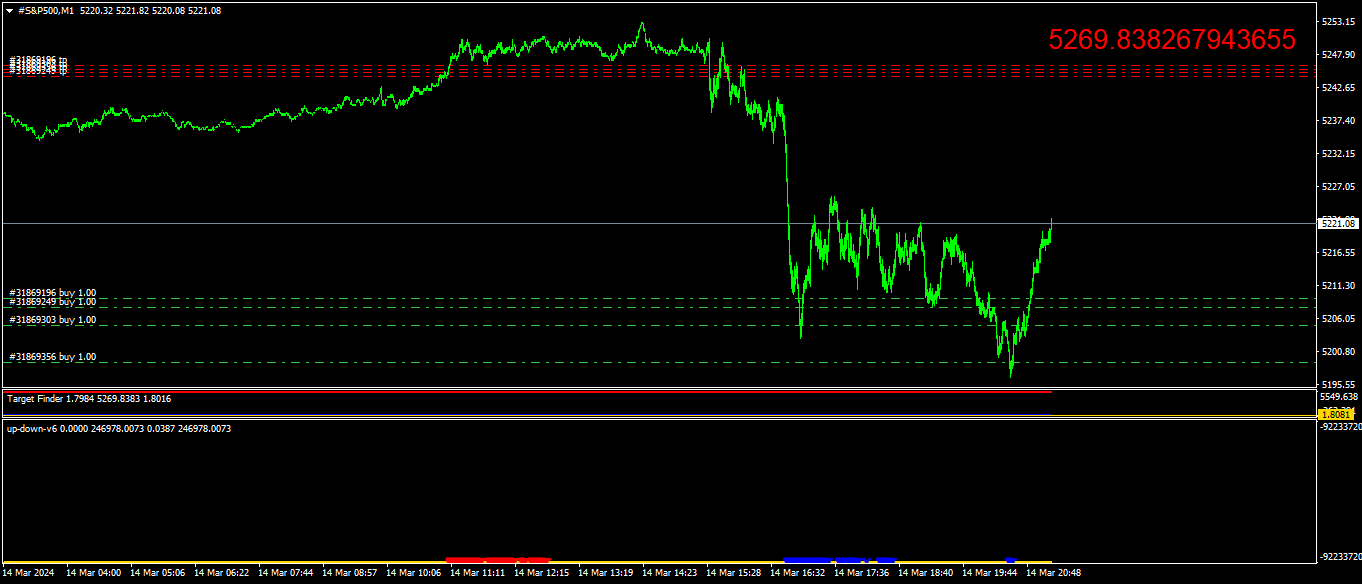

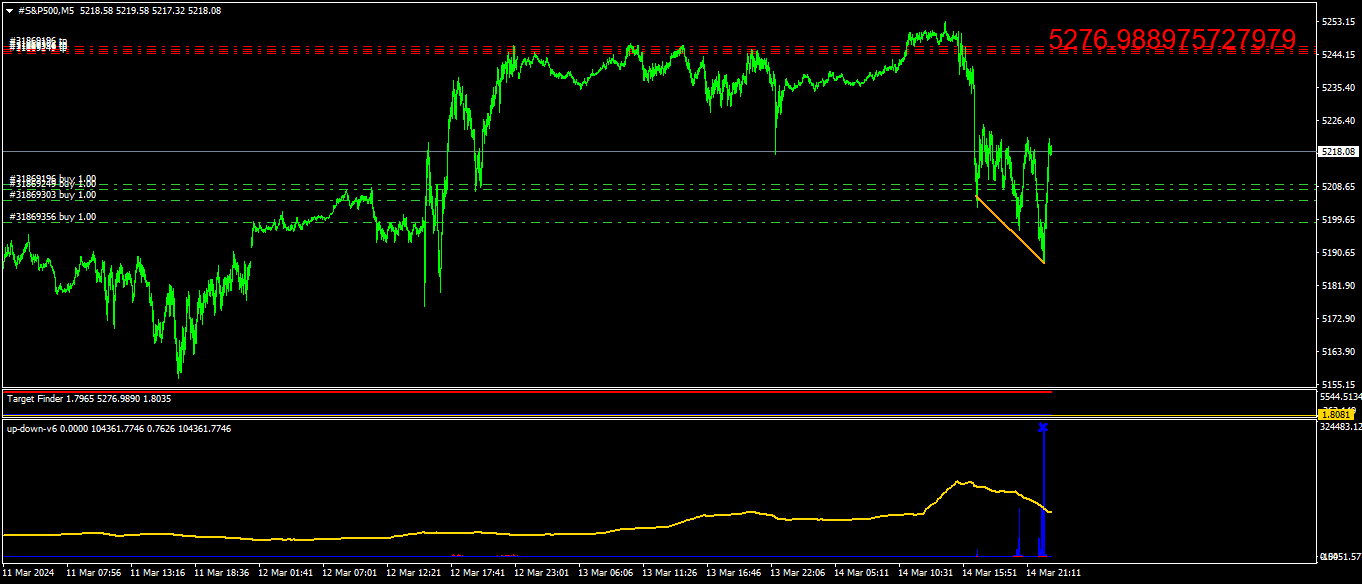

704The real question is how you adjust for instances like the one that happened below today with the US30 on the M1 timeframe:

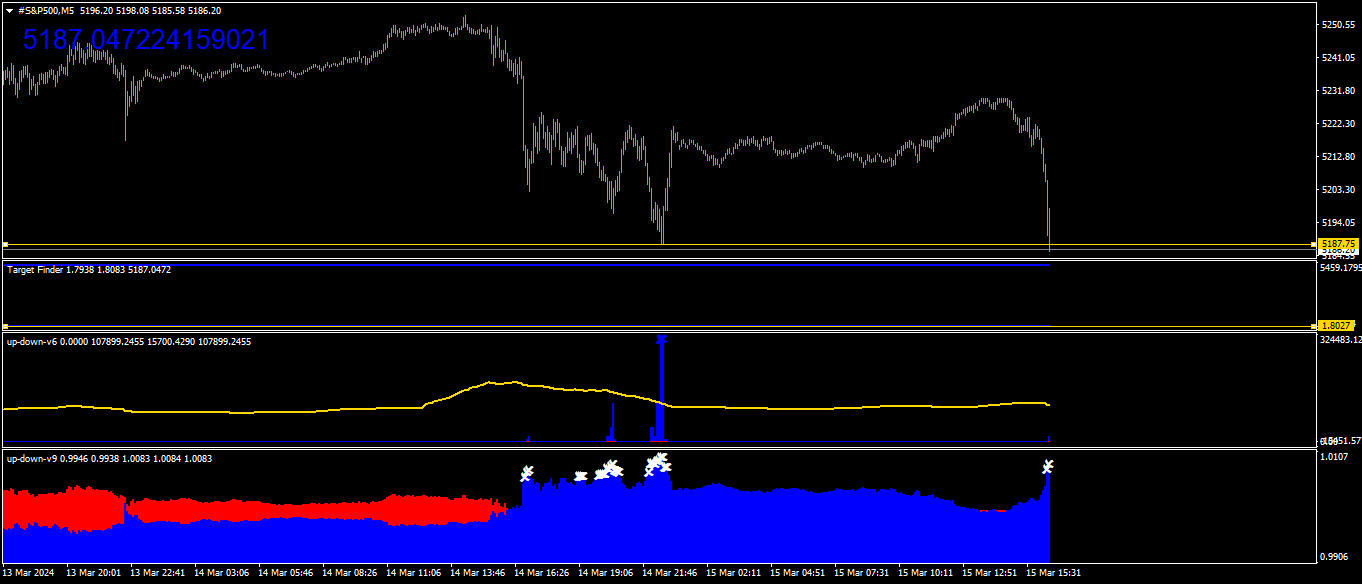

Notice that although Up Down V9 gives us two very long lines of repeated signals for buy and sell trades, we expect this as it's a short-term cycle indicator.

With Up Down V6 we get less of that but the same phenomenon occurs. At least we have a c-value that can be adjusted to have this happening less frequently, but the same cannot be said for V9.

Really goes to show why higher timeframe analysis and c-value adjustment are especially important during trending markets where price keeps on going up or down with no signs of stopping.

Notice that although Up Down V9 gives us two very long lines of repeated signals for buy and sell trades, we expect this as it's a short-term cycle indicator.

With Up Down V6 we get less of that but the same phenomenon occurs. At least we have a c-value that can be adjusted to have this happening less frequently, but the same cannot be said for V9.

Really goes to show why higher timeframe analysis and c-value adjustment are especially important during trending markets where price keeps on going up or down with no signs of stopping.

- These users thanked the author TransparentTrader for the post:

- anscari1714

- Rating: 0.6%

Re: $100 Up Down V6 indicator

705- These users thanked the author guner for the post:

- TransparentTrader

- Rating: 0.6%

Re: $100 Up Down V6 indicator

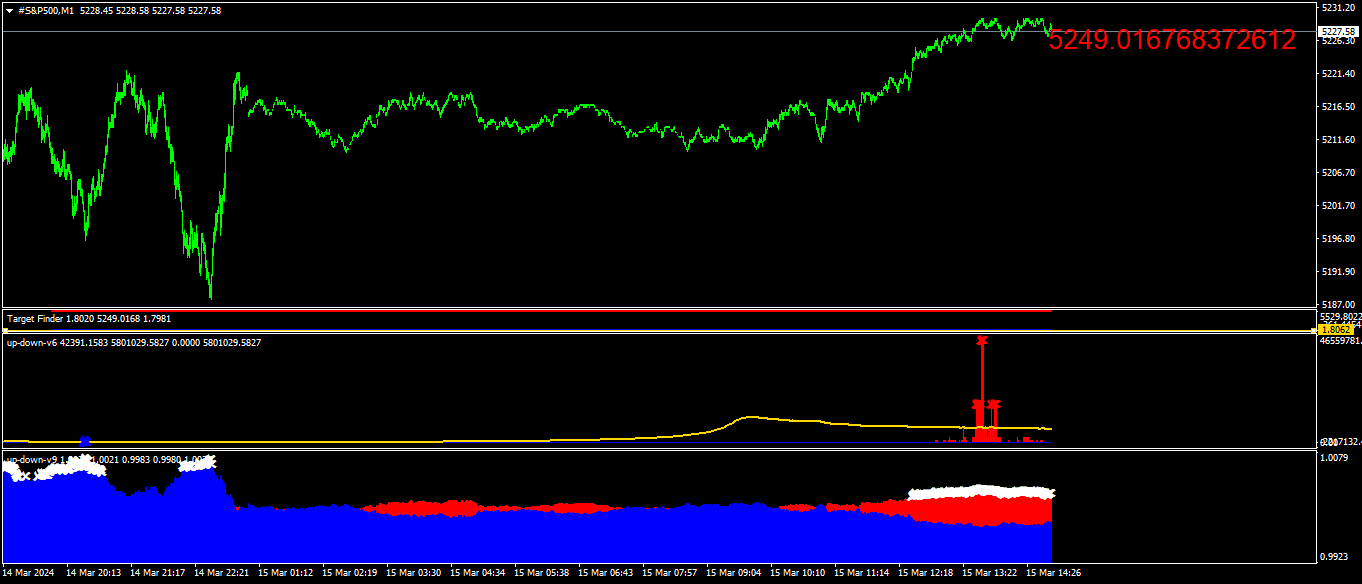

707Interesting that the last swing low didn't trigger a buy signal from the V6 indicator.

Guner, give that each trade was 1 lot size with your broker, can you tell us the drawdown you incurred for each individual trade and all 4 trades together when price was at that most recent swing low?

Also, what broker are you using to place these demo/live trades?