Global Currency Trading Surges to $6.6 Trillion-A-Day Market

.

.

(Bloomberg) -- Trading in the global foreign-exchange market has jumped to the highest-ever level at $6.6 trillion, according to the Bank for International Settlements.

The average daily trading in April was up 29% from $5.1 trillion in the same month in 2016, the BIS reported Monday in a triennial survey on the industry. The growth of FX derivatives trading, primarily swaps, outpaced the spot market and now accounts for almost half of global FX turnover.

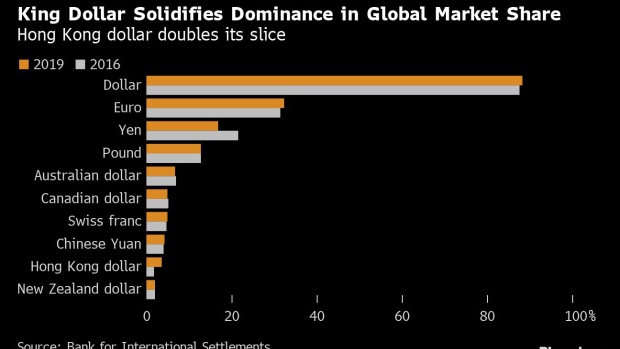

The three years since the previous BIS survey has been marked by a slide and then strong recovery in the dollar, which remains the world’s preeminent currency. Nearly nine out of every 10 currency trades are against the greenback. As a trading center, the U.S. has fared less well, losing ground to London, which has shrugged off Brexit uncertainty to account for 43% of all activity.

“The U.S. dollar retained its dominant currency status, being on one side of 88% of all trades,” BIS said. “Currencies of emerging market economies again gained market share, reaching 25% of overall global turnover.”

The share of trading in the U.S. slipped to 17%. Along with Hong Kong, Singapore and Japan, the U.K. and U.S. facilitated more than three-quarters of the total. Mainland China saw a significant rise to become the eighth-largest center, according to BIS.

The share of trades involving the euro increased to 32%, while the yen slipped to 17% yet held its spot as the third-most actively traded. A factor for the decline in yen trading may have been reduced price swings seen in April, BIS said. A JPMorgan Volatility Index of Group-of-Seven currencies collapsed that month to its lowest since 2014.

The yuan’s slice of the market remained steady at around 4%, just behind the Swiss franc.

New traders such as XTX Markets have started to muscle their way into the ranks of the biggest currency dealers, alongside banks. It was rated the fourth biggest in an annual foreign-exchange survey from Euromoney Institutional Investor Plc. JPMorgan Chase & Co. was the largest with a 9.8% market share, with Deutsche Bank AG following at 8.4% and Citigroup Inc. with 7.9%.

While spot currency trading rose 20% to $2 trillion a day, as a share of global FX activity it fell to 30% in April, from a third in 2016 and 38% in 2013. The use of swaps, which allow an investor to borrow one currency from a counter-party while simultaneously lending a second currency to another, climbed more than a third to $3.2 trillion. The growth may reflect the greater need to hedge given growing global trade worries and political risks.

Trading of outright forwards also increased, with a large part of the rise due to non-deliverable forwards. That reflected strong activity in NDF markets for the Korean won, Indian rupee and Brazilian real, the BIS said.

“While we’ve seen growth across all forms of FX trading, swaps and forwards have seen particular growth,” said Matthew Hodgson, CEO and founder of Mosaic Smart Data, which provides data analytics to currency desks at banks. “The FX market has woken up.”

To contact the reporters on this story: Anooja Debnath in London at

adebnath@bloomberg.net;Susanne Barton in New York at

swalker33@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at

bpurvis@bloomberg.net, Neil Chatterjee, William Shaw

https://www.bnnbloomberg.ca/global-curr ... -1.1316841