[quote=ItalianTrader post_id=1295509645 time=1681391653 user_id=4942695]

Previous morning trade , Sl hitted , any thoughts ?

Not an expert but i do not see shorts here only longs

Re: A New Trading Game (chaos game) Played for Money and Played in Risk- Free Space

752By looking at the " then " picture there's another story..

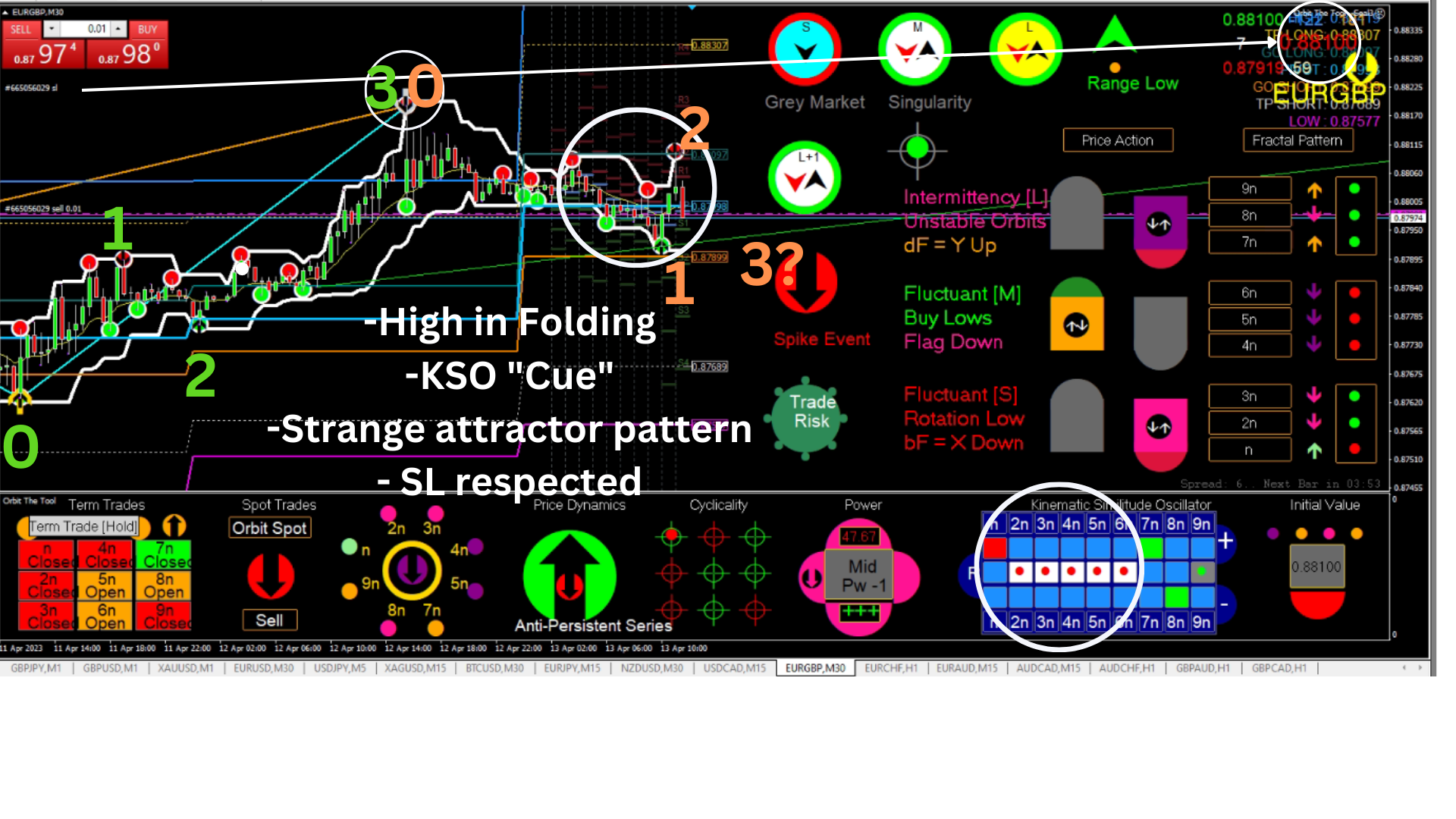

But looking at the "before" picture, i feel the trade was in a perfect setup :

- High in a folding range

- Strange attractor pattern

- Screenface n-6n coherence

- SL as per screenface

Nevertheless a new low wasn't reached and a new high estabilished. I don't know if I may missed something.

- These users thanked the author ItalianTrader for the post:

- regit

Re: A New Trading Game (chaos game) Played for Money and Played in Risk- Free Space

753So then the gist of the matter is that due to the limitations imposed by attemtping to map the fractal stretchings and foldings onto the visual output of MT4, the actual 1-2-3 stretch-fold-stretch that is seen in the mathematical calculations (and topological map?) can and at times will be appear distorted as it is viewed via visual aids such as the zigzag indicators.Darkdoji wrote: Fri Apr 14, 2023 12:07 am We do not directly use levels here and there are 5 weights in our scheme not 3 (referring to @regit here not @ImpLaNT who to my mind gets it). Good to look at things in the way we present them to gain our thinking. Please see Assessor Manual for that thinking. Also resolutions are complexed to infinity and it is sufficient most times to accept the broad view. What seems incomplete at some resolution is in fact complete at the next or lower than the next and no information is in fact lost. The presentation of the market (by Metaquotes), as a series of bars etc is not always helpful in evaluating a study in the mathematics of a single point in bounded complex space (you use your imagination a lot to form the desired picture). Further, the mathematics is topology which does not necessarily express as we see or understand "correctness." We are not in the "countable" realm. In a general sense (cannot stress this enough), sometimes the pristine in our desire is simply pedantic and adds no value to our cause. What is not a critical point to understanding behaviour and analysis or outcome is best treated as such - noncritical. Good to focus on the fact that in markets, everywhere we turn we see homoeomorphic transformations in progress and that is not in dispute. It is this result that takes us where we desire and nothing else.

(-_-)

The Crow hates eating crow, but serves himself nearly every day.

Re: A New Trading Game (chaos game) Played for Money and Played in Risk- Free Space

754Nevertheless a new low wasn't reached and a new high estabilished. I don't know if I may missed something.

[/quote]

from your red 0 to 1 low we can draw a 1-2-3 easily. But from 1 to 2 red up only 3 candles there is an arrow down yes but do you see a clear 1-2-3 up pattern here? In other words do you like the picture here for me this is a mini move and not clear despite this black arrow down.

perhaps 5M chart is more clear. DJ told here he respects Dow theory so why shorting higher highs anyway?

[/quote]

from your red 0 to 1 low we can draw a 1-2-3 easily. But from 1 to 2 red up only 3 candles there is an arrow down yes but do you see a clear 1-2-3 up pattern here? In other words do you like the picture here for me this is a mini move and not clear despite this black arrow down.

perhaps 5M chart is more clear. DJ told here he respects Dow theory so why shorting higher highs anyway?

Re: A New Trading Game (chaos game) Played for Money and Played in Risk- Free Space

755Sorry if this is late for you -----------------> I think it is a question merely of failing to scope the market to a) recognize you were in a cyclic trend higher b) and to guess the space in direction otherwise you did well frankly - you were methodical and present minded in the trading.

a) Look at your before screenshot - at the point of entry you were right except that you did not look to your immediate past which would suggest the attractor was probably recursive ahead because of course the last high before your trade was called by a higher low so there was a hint to look at TF +2, and 3 to check for space in direction and attractor positioning.

b) Hopefully next time consider that a cyclic trend going up always has a high associated with a higher low and this pattern is recursive until it inverts (hence the term cyclic trend). As you can see from the pattern behind your point of entry, given such a trend, it might trigger the thought that the same could recur and the only solution is to check ahead in time frames ahead of your trade frame for space in direction, i.e. to guess the chance of continuation of the cyclic trend and project the attractor up instead of down then wait for indications from the screenface at the low. But well done.

(-_-)

- These users thanked the author Darkdoji for the post (total 2):

- ItalianTrader, regit

Re: A New Trading Game (chaos game) Played for Money and Played in Risk- Free Space

756No but cannot keep eyes open so tomorrow.regit wrote: Fri Apr 14, 2023 2:44 am So then the gist of the matter is that due to the limitations imposed by attemtping to map the fractal stretchings and foldings onto the visual output of MT4, the actual 1-2-3 stretch-fold-stretch that is seen in the mathematical calculations (and topological map?) can and at times will be appear distorted as it is viewed via visual aids such as the zigzag indicators.

(-_-)

Re: A New Trading Game (chaos game) Played for Money and Played in Risk- Free Space

757Meyney wrote: Fri Apr 14, 2023 3:16 am

perhaps 5M chart is more clear. DJ told here he respects Dow theory so why shorting higher highs anyway?

I also want to draw your attention to the use the MRI lines. Look at the downward moving literally ends at the red MRI line, which should be interpreted as ... the price was not allowed into the sell zone. Accordingly, growth resumed. Pay attention to MRI too.

Re: A New Trading Game (chaos game) Played for Money and Played in Risk- Free Space

758STRATEGY

From @Italian's kind presentation of his unhappy trade, it hit me that the question of market scoping for traders not using multiple screens to trade is a significant one that merits consideration and discussion within the thread.

Below is my suggestion based on the properties of markets studied in this forum.

Is there some risk to this approach? What opportunities do we see? And how sound is the idea? Well those are all points we can discuss in open forum, but from experience the probability of consistent reward appears higher than the risk. Of course experts like @Meney, @ImpLaNT, @regit, @Italian et al might give us more insights and opinions to guide further thought and of course practice.

The idea as such is simple enough - i.e. mirror-trade 6n from any lesser trade window (but clearly everything in trading is easier said than done).

The Crow -Inverted (_-_)

From @Italian's kind presentation of his unhappy trade, it hit me that the question of market scoping for traders not using multiple screens to trade is a significant one that merits consideration and discussion within the thread.

Below is my suggestion based on the properties of markets studied in this forum.

Is there some risk to this approach? What opportunities do we see? And how sound is the idea? Well those are all points we can discuss in open forum, but from experience the probability of consistent reward appears higher than the risk. Of course experts like @Meney, @ImpLaNT, @regit, @Italian et al might give us more insights and opinions to guide further thought and of course practice.

The idea as such is simple enough - i.e. mirror-trade 6n from any lesser trade window (but clearly everything in trading is easier said than done).

The Crow -Inverted (_-_)

- These users thanked the author Darkdoji for the post (total 3):

- ItalianTrader, ImpLaNT, regit

Re: A New Trading Game (chaos game) Played for Money and Played in Risk- Free Space

759Live Trade - Situation similar to yesterday but different in semaphor's context in higher TFs .

H1 persective H4 perspective Cheers

H1 persective H4 perspective Cheers

- These users thanked the author ItalianTrader for the post (total 3):

- Darkdoji, ImpLaNT, regit

Re: A New Trading Game (chaos game) Played for Money and Played in Risk- Free Space

760Today's Trade TP.

- These users thanked the author ItalianTrader for the post (total 3):

- ImpLaNT, Jackson Doh, regit